You probably don’t know, nor did we, so we have done the check.

The DAX started at 1000 points on 31 December 1987. It closed the year 2016 at 11481 points. That gives a compound average return of 8.8% per annum. Who is asking for more?

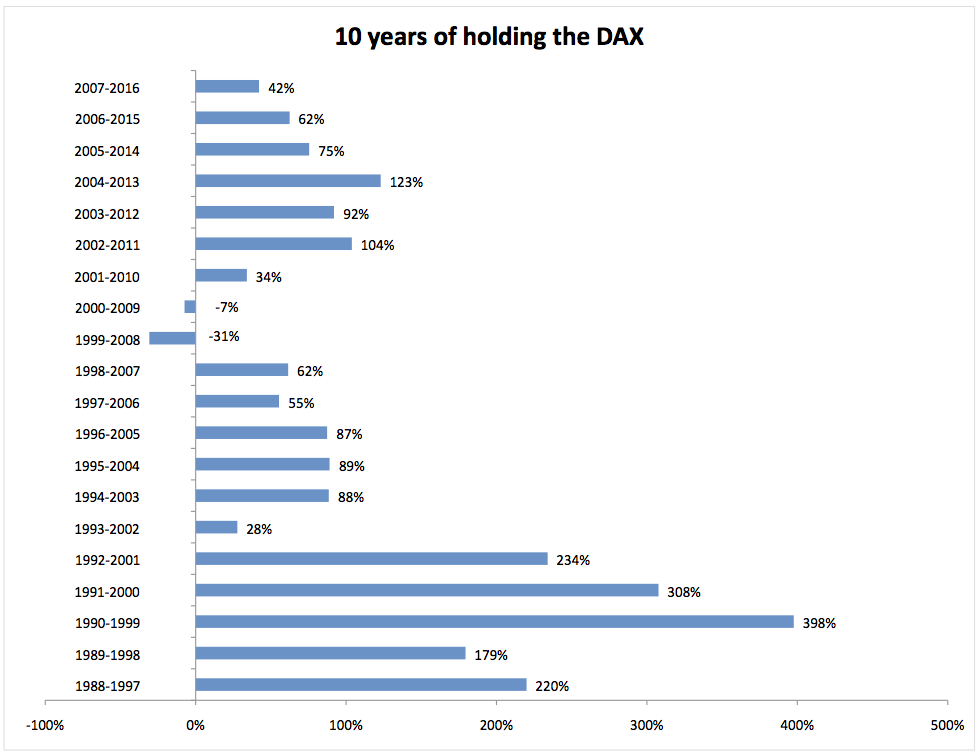

OK, we have also checked the annual performance in every single year since 1987. Here are the results, assuming that you would have hold the DAX for 10 years. This gives us a total of 20 investment periods (assuming that you would have invested on the 1 January of the period and sell on the 31 December at the period end).

The return for holding the DAX for 10 years was, on average, 112% i.e. the money invested doubled in value over 10 years. True, some periods were better than others. Note that 18 investment periods were positive, and only 2 negative: if you had invested close to the highest point and sold close to the lowest point (1999-2008; 2000-2009). But would you have done that? Probably not.

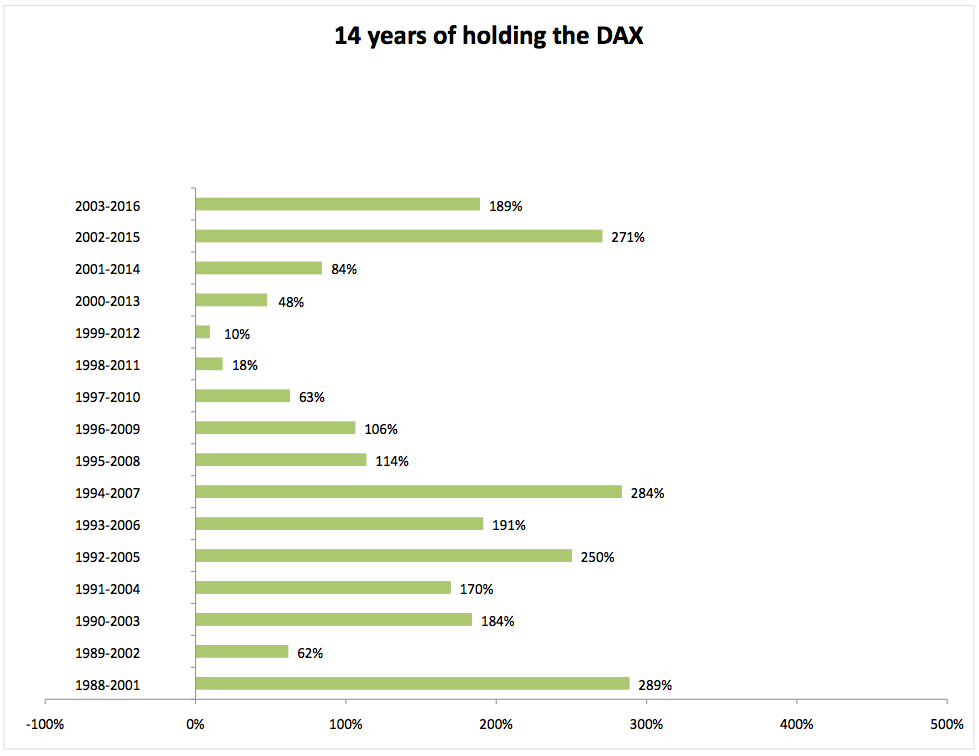

Most likely you would have waited a couple of more years before selling, until you were back ‚above the water‘. If you take a 14-year investment horizon, then the return would always have been positive i.e. your initial investment would never have decreased in value (at least before inflation), as shown below. In 8 periods out of 15, the return would actually have been between 150% and 300%!

That’s why we keep repeating that:

- you need to take a 10-15 year investment horizon when you invest in stocks. If this sounds long, you know that time passes faster than you think, don’t you? (was the time that it took for your kids to grow from birth to the age of 14 such a long time?)

- historically, and statistically, you could not have lost money for buying into the DAX and holding your investment, passively, for 14 years.