Rather than buying shares in a single company, you can (and should) buy shares in multiple companies. This considerably reduces the risks that you are taking.

Let us assume that you are a shareholder in 30 companies: if one goes bankrupt, this is bad, but it won’t ruin you. And this does happen in practice: if you had bought all the 30 companies that were in the DAX in an equal manner, including Hypo Real Estate (HRE), in 2006, and then lost your money after the squeeze out / nationalisation of HRE in 2009, then your investment in HRE was lost. But the other companies in the DAX have done well, and the DAX Performance index increased from 6700 points at end 2006 to 11481 points at end 2016. This is an increase of 42% over the last 10 years, which is below average, but still OK, and certainly not a disaster.

The other benefit of owning shares in multiple companies is that the volatility of your portfolio is reduced, as long as you hold a diversified portfolio. Note that if all companies are in the same industry, then their share price is correlated, and this does reduce volatility a little, but not as much as investing across multiple industries and multiple countries or regions. That’s why we prefer country and regional ETFs and Funds, rather than sector (industry) funds.

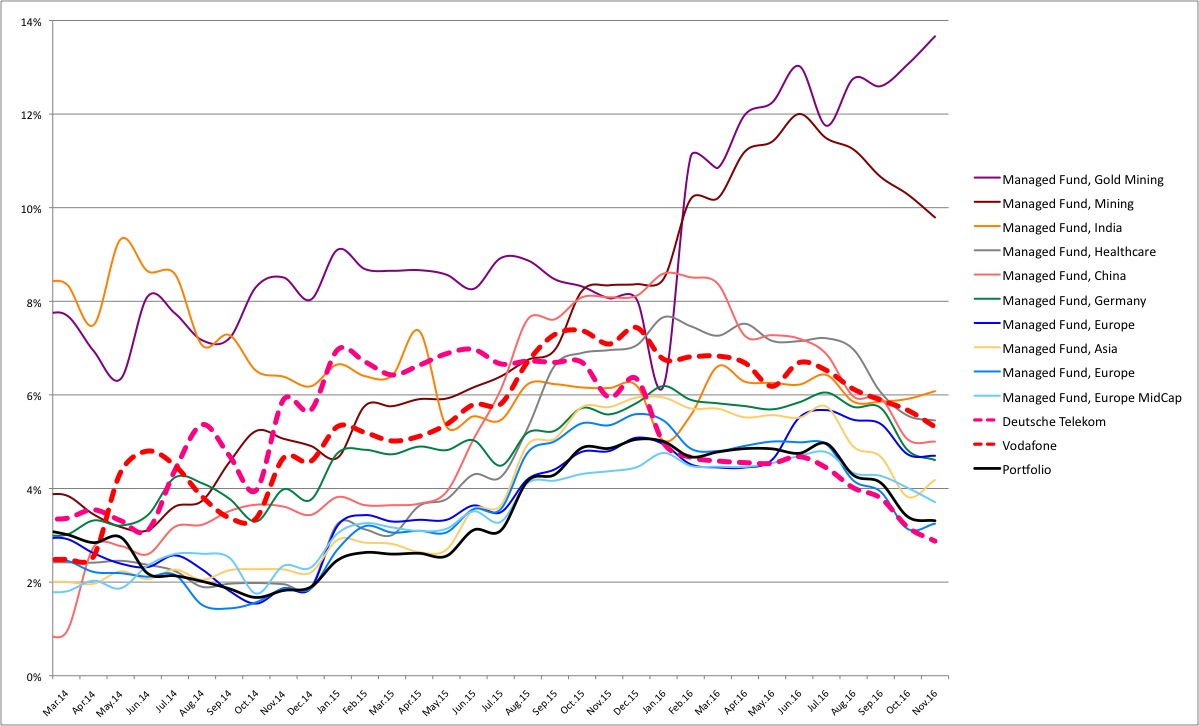

The following chart show the volatility of monthly returns and illustrate the point. It has been prepared with real data and a real portfolio, based on 10 managed funds and 2 telecoms stocks. There are quite a few lessons to learn from this chart:

- The volatility of returns is not constant, but varies over time! It is sometimes higher, sometimes lower.

- The volatility of the portfolio returns (the curve in black) is clearly lower than the volatility of most managed funds that the portfolio is made of. Occasionally, a single managed fund might have a lower volatility than the portfolio, but it doesn’t keep this advantage over time.

- The managed fund investing in German shares (in green; this fund invests in large and mid caps) has a higher volatility than the three managed funds investing in European shares (in blue)

- The volatility of the single-country ‚India‘ and ‚China‘ managed funds is higher than the volatility of the ‚Asia‘ fund (they are displayed in orange).

- The volatility of returns for the Deutsche Telekom and Vodafone shares is also displayed on the chart: it is higher than most of the (diversified) managed funds volatilities. But not for Deutsche Telekom in the year 2016: its volatility has been very low (god know why).

- The volatility of the ‚Healthcare‘ managed fund (the curve in grey), traditionally and historically low, has been high since the end of 2015.

- The volatility of the ‚Mining‘ and ‚Gold Mining‘ managed funds are particularly high, and much higher than all other funds in 2016.

So in summary, your portfolio should be diversified as it helps reduce volatility, while keeping your portfolio return high. The portfolio shown above is actually made at least 50% European funds, so its performance will largely follow the returns of European stocks.

Now, there are more than 68,000 listed companies worldwide. Which ones should you be buying? There are 2 fundamentally different phylosophies, which represent two extremes:

- you buy shares in a large number (30-50) of companies, diversified across various industries, countries and even continents

- or you buy funds (managed or non-managed i.e. ETFs), so that rather than buying into companies directly, you buy through an entity (the fund) that is making the investment on your behalf. Typically, a fund will invest in 30-50 shares, so buying 5-10 funds gives you access to a very large universe and helps you ‚own the whole world‘, thereby bringing maximum diversification geographically.