When you buy shares in a stock exchange, you are not betting money in a casino, but you are buying a piece of a business, and therefore become a business (co-)owner. You buy a financial asset, but this is a company with real assets that are necessary for the company to operate (plants, equipment, tools, software, intellectual property rights, land, building etc). And businesses need time to grow and develop.

When you buy a house, you don’t plan to sell it the following month, or the following year, but you expect to keep it for 10 years or longer, don’t you?

It is the same with shares. Although your investment is very liquid compared to real estate, and you can sell your shares at any time, you should really take a long-term view. You need to give time to the business that you are investing in. If you are in a hurry, you shouldn’t own shares, unless you understand that you are speculating.

The other benefit of taking a long-term view is to smooth out the volatility of the share prices and returns. When you invest in sound and good businesses, the daily fluctuation of its share price in the stock exchange doesn’t really matter. In the short term, the volatility can be high, but in the long term, the volatility will be low. And if you have patience, the return on your initial investment can be high.

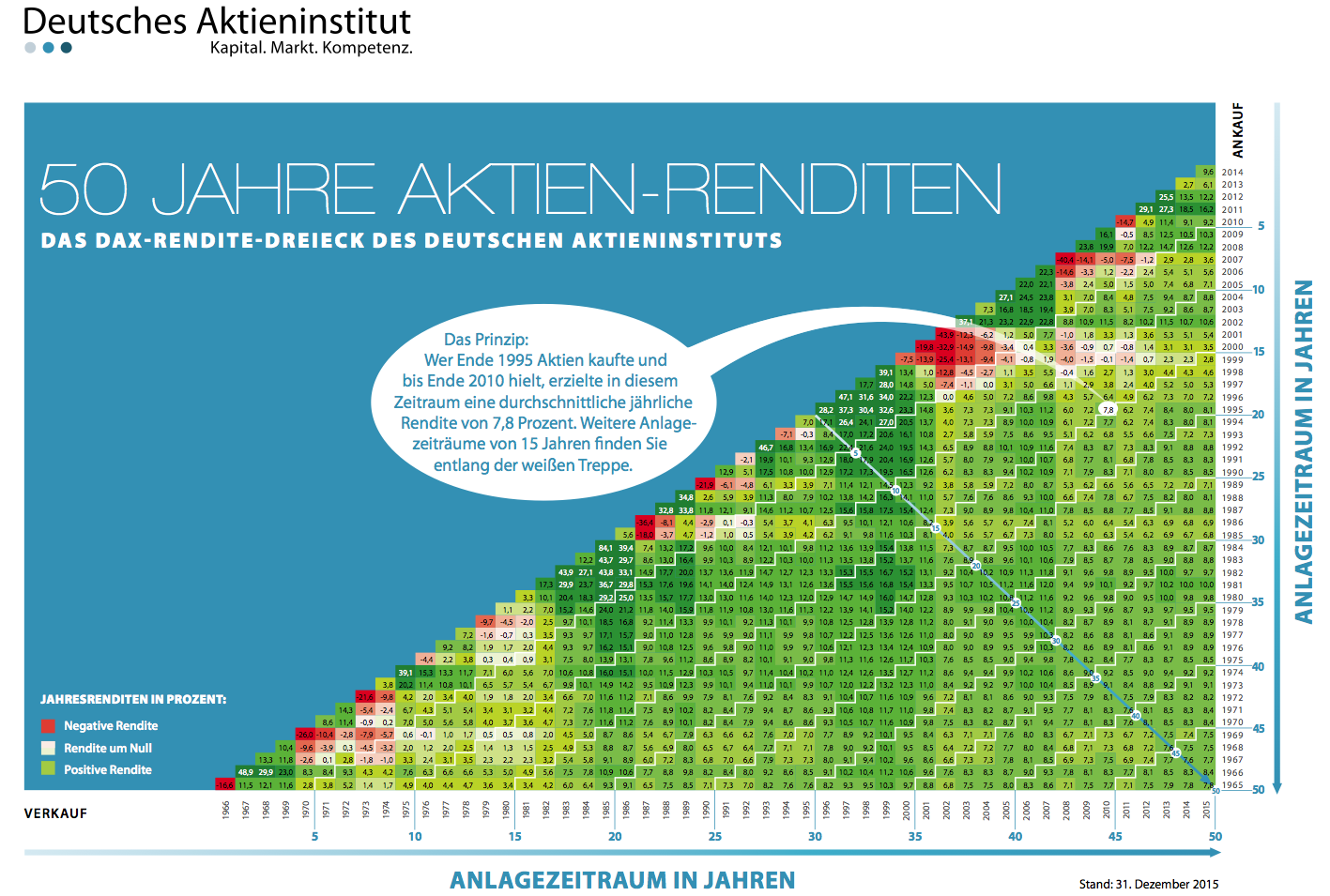

Although the future won’t necessarily replicate the past, it is always insightful to check how the prices of shares have been changing over the last 10, 15, 20 or 30 years. The diagram below provides an overview of the DAX return over the last 50 years (performance index i.e. including dividends).

Historically, if you had invested money in a DAX index in the past and kept it for 13-14 years and more, you could never have lost money. And the average 10-year performance sine 1987 has been 112%. This means that keeping the DAX for 10 years has, on average, more than double the initial investment.