A company can go bankrupt. That is rare but it does happen. In this unfortunate event, if you are a shareholder of that company, the value of your shares would become nil, or close to nil. If you have been a shareholder in companies such as Hypo Real Estate (Germany; nationalised in 2009 by the state), or Enron (USA; insolvency in 2001 following an accounting scandal), or MCI Worldcom (USA; insolvency in 2002), Lehman Brothers (USA; insolvency in 2008), then you understand what that means. So having ownership in a single company can be very risky, and you might lose your original investment in that company entirely.

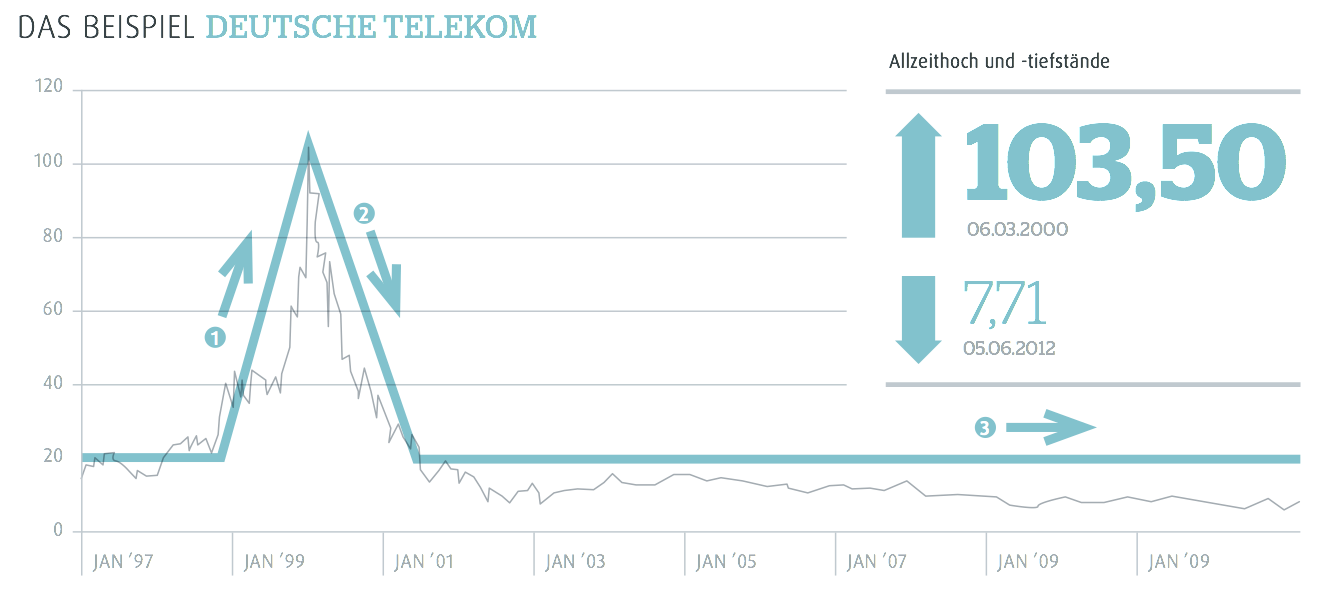

Even if a company is not insolvent, its share price can vary widely. Take Deutsche Telekom AG for example. If you have bought shares of the company in 1999 or 2000, then you have lost money (so far).

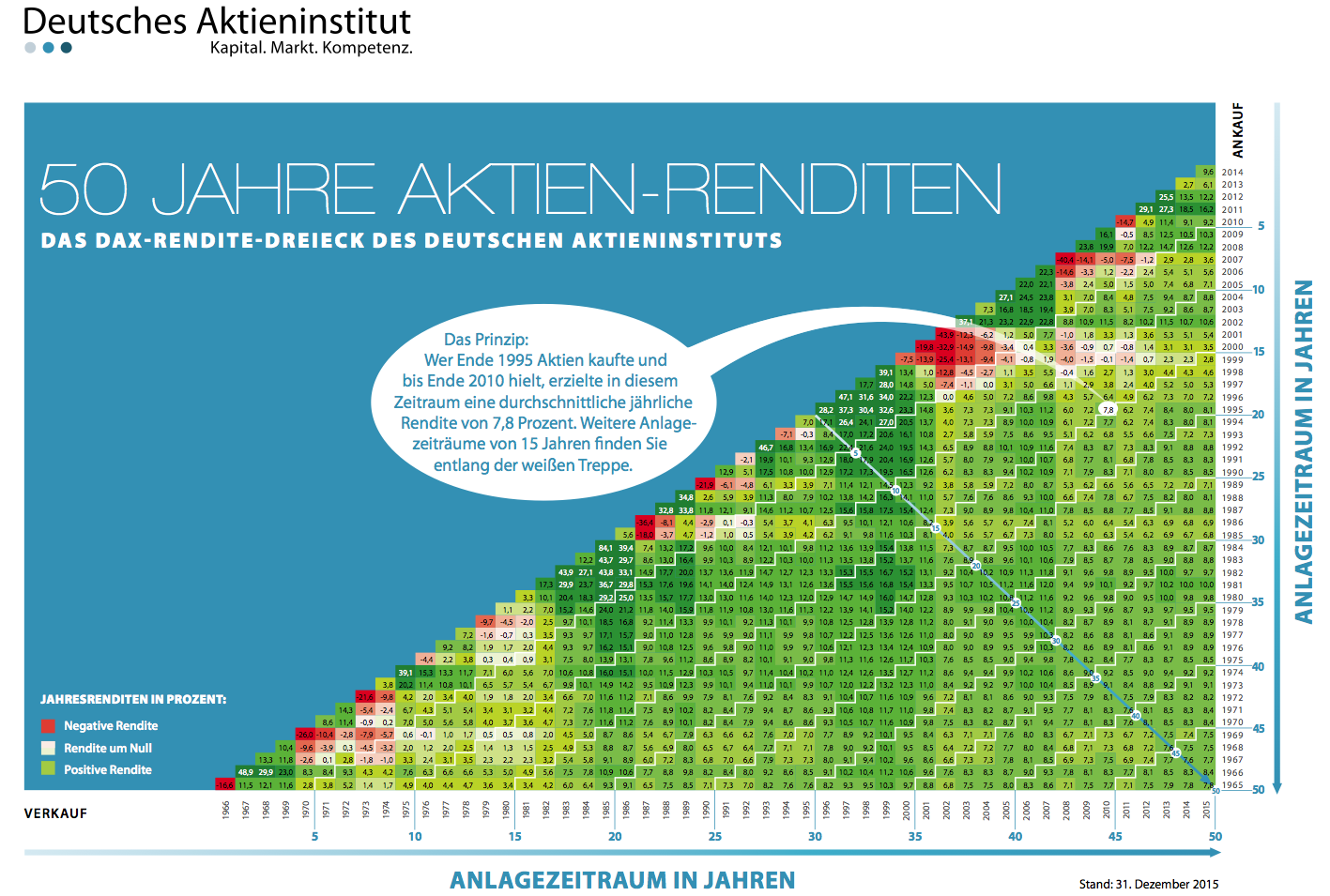

But there is a wonderful way to mitigate the risks, via diversification: over multiple companies, and over time. If you buy a large enough group of companies, such as a DAX index (30 companies), and have time and patience, then historical data show they you are on the winner side, as shown by the 50-year return map below.

What the map shows is that if you had invested in the DAX and kept your investment for 13 year or longer, historically the return has always been positive. Put it another way: you couldn’t lose money. And the average annual return was often large, with an average of 7%-9% over the long term.

Sure, companies do go bankrupt (rarely), but if you own shares in a diversified and balanced portfolio of 30 companies, even if one of them goes bankrupt, it won’t be a disaster for your portfolio.