Hi! My name is Black Belt 001. I am one of the founder of the MyMoneyWorks platform.

I am an average guy. Averagely good looking, averagely smart, with an average job, and an average house. It’s good to be realistic – most people believe that they are above average, for example that they “drive better than the average driver” (which is not the case: 90% of the population cannot be driving better than the average, statistically speaking).

So I am a normal guy. However, I believe that I have been a better investor than 90% of the German population in the last 10 years. And I guess that’s why you should continue reading.

Oh, and how do I know that?

Simple: less than 10% of Germans own shares, and I am one of them, and shares have performed pretty well over the period 2006-2015: +100% for my portfolio, with a mostly passive strategy (and I must admit: plenty of ups and downs). If I can do it, then anybody can do it. As long as you don’t make big mistakes, it is largely a ‘no-brainer’.

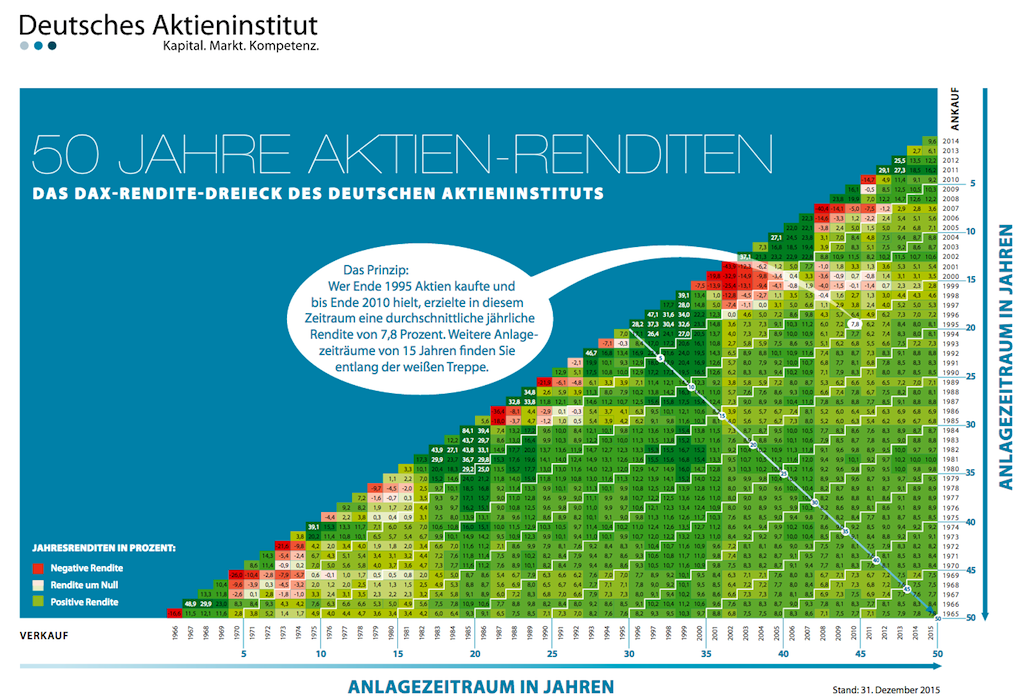

By the way, +100% over 10 years was no better nor no worse than the DAX, it was simply average, as I keep telling you! But I am happy being ‘average’, when 10-year returns are +100%. If you don’t believe me, then read the 10 years of holding the DAX post or check the 50-year DAX Return Triangle.

So I must have done better with my savings than the 90% of the Germans who left their money dormant. If you want to be above average yourself in the way that you manage your savings, then a good way to start is to read the ‘Faktbook Aktie’ in our next post: Deutschland, das Land der Aktienmuffel. Enjoy!