If you have read the Principles 1-7, by now you should agree with us that stock picking can be fun, but is a risky game. At the end of the day, rather than losing your time (and money) trying to figure out which are the best stocks to buy, you should ask yourself more important and better questions:

- How should I split my savings between (dormant) cash, bonds and shares? We don’t like bonds because their returns are too low (and they are not without risks), so if you exclude them as well, the question becomes: how much of my (dormant) cash should I invest in shares (directly or via ETFs, or via Managed Funds if you don’t like ETFs)?

- Which ‘sector’ should I buy? Telecoms? Healthcare? Energy? Industrials? Buying a sector ETF is a risky game, because all the shares in the sector ETF are correlated. So unless you feel really strong about a particular sector, you shouldn’t buy any.

- Which ‘countries’ should I buy? German shares? Swedish shares? USA shares? English shares? Emerging market shares? Once you know how much money you want to invest in shares, this is the only question that matters.

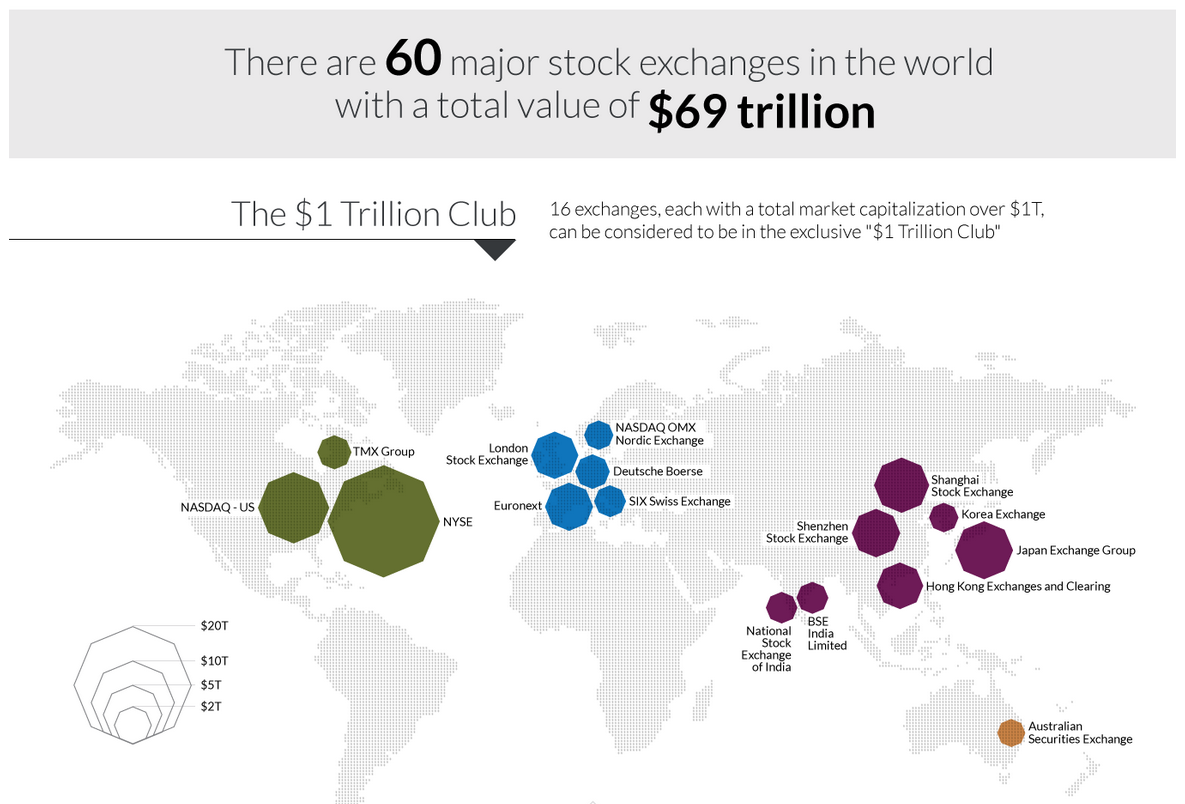

People who live in Sweden tend to buy Swedish shares and end-up with a ‘very Swedish portfolio’. But is this the right thing to do, when you think that the value of the Swedish stock market is less than 1% of the value of all the world stock market combined (USD 69 000 billion capitalisation)?

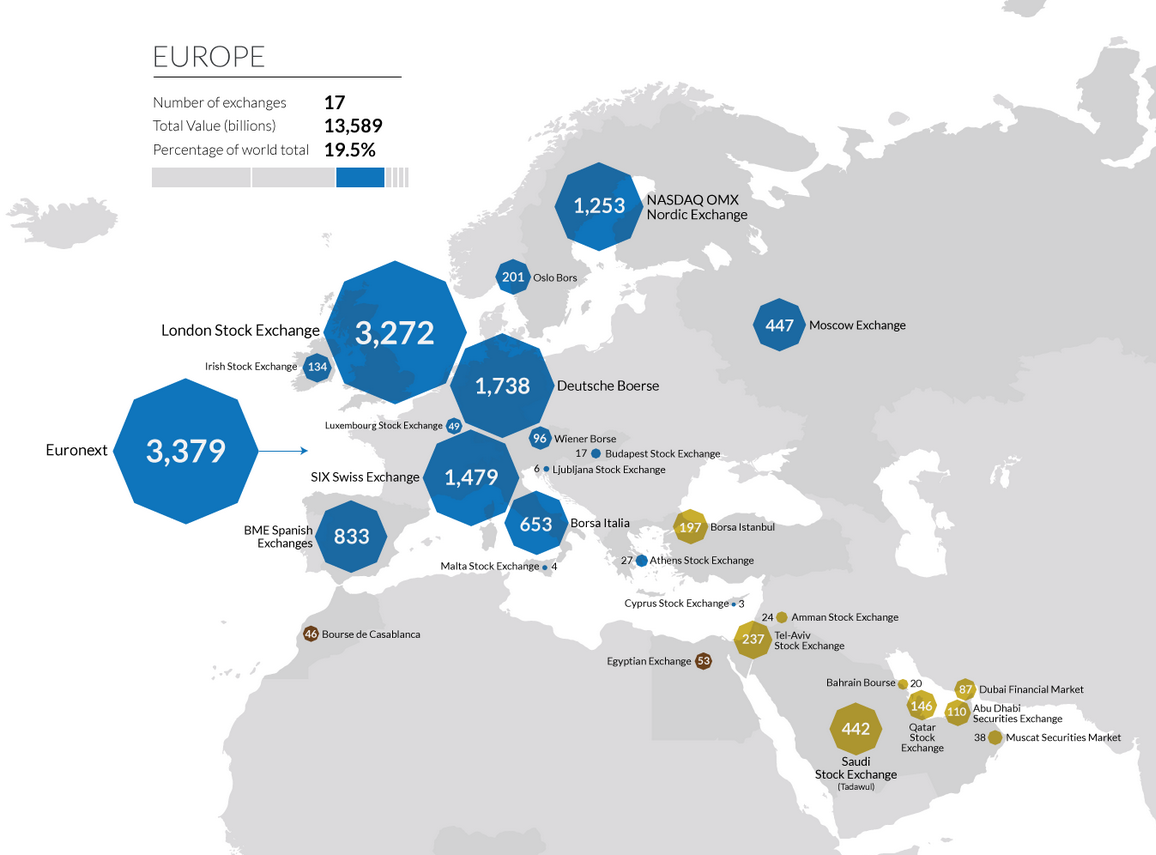

The same applies to Germany. Why put all your money in German listed companies, when the German stock market capitalisation (USD 1700 billion) is only 3% of the capitalisation of all listed companies worldwide?

Source: www.visualcapitalist.com

A better approach is to allocate your investments over 3-5 geographies, such as:

- Germany if you are in Germany

- Europe

- the USA

- emerging markets such as China, India, and Asia as a whole

The allocation of your investments over the geographies (for example via ETF indexes) will have the largest impact on your portfolio performance. Not the individual selection of stocks within specific regions and countries.

If you are not sure how to split your investment, then you will do as most people do: a large portion in Germany (and Europe?) and a smaller portion in the USA and the rest of the world. Say 30% in Germany, 30% in Europe, 30% in the USA (with a currency exchange risk between the Euro and the USA), and 10% in emerging markets. This should do better than 100% in Germany, and much better than 100% on a single German stock…

Source: www.visualcapitalist.com