When you buy a share of equity, you buy a (small) piece of a company and ownership in a business. You become a shareholder.

There is nothing speculative about that, in the contrary: the act of investing in companies is an act of faith in the economy in general, and the future development of the selected companies in particular.

As a business owner, you will usually get dividends, which represent the profits made by the business that are distributed to shareholders. Profits that are not distributed to shareholders are reinvested into the business (to finance the development of new products, or growth in new markets, or other acquisition of other companies).

Typically, shares have voting rights attached to them, so if you buy shares directly (not via managed funds, or ETFs), then you will be invited to the annual general meeting. Sure, with a small ownership, your influence on the company’s strategic decisions will be very limited. But you will be a business (co-)owner nonetheless.

Listed shares can be bought and sold on the stock market(s) where the companies are listed. The price of the shares reflect the interplay of demand and supply. Prices can be very volatile over time, as buyers and sellers have different opinion about the true, intrinsic value of the company. And also because in the short term, the total supply of shares is mostly fixed (share capital increases and IPOs are not so many, and take time). So the short-term volatility is mostly driven by changes on the demand side, i.e. growing or decreasing appetite by individual and institutional shareholders and to own shares.

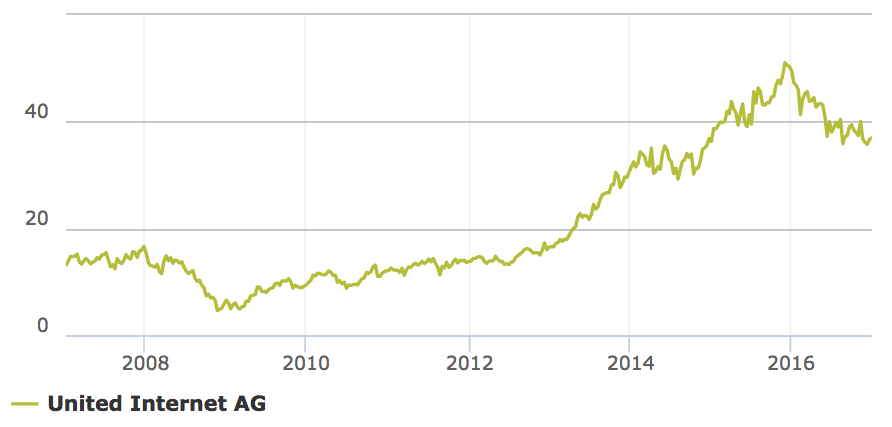

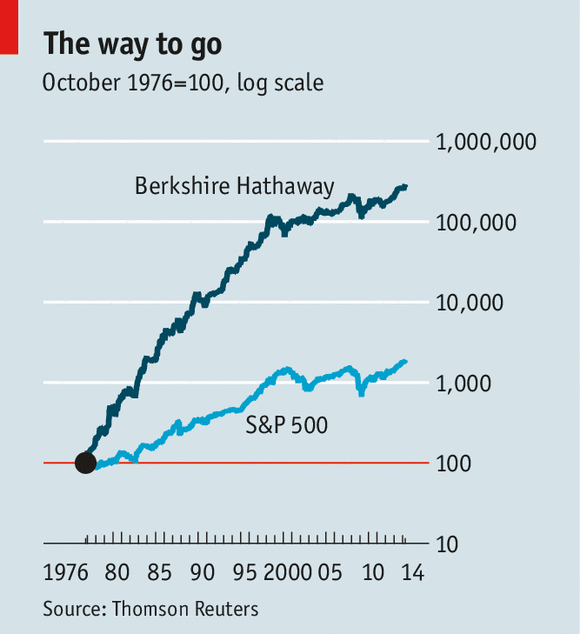

But share prices can also steadily (but irregularly) increase over time, and this is what happens for most companies. People employed in companies are working hard to create new products and services for their customers, and as the overall economy grows, the results are visible in increased share prices. Below some remarkable examples from Germany (United Internet) and the USA (Berkshire Hathaway) respectively. And what happened with the share value of United Internet before 1998? Well, a lot! The company was first listed in 1998 at a price of €1,02 per share. At end 2016, the share price was €37. That’s an increase by a factor of more than 30 over less than 20 years. Sure, with plenty of ups and some downs during the last 20 years, but many more ups than downs.

But share prices can also steadily (but irregularly) increase over time, and this is what happens for most companies. People employed in companies are working hard to create new products and services for their customers, and as the overall economy grows, the results are visible in increased share prices. Below some remarkable examples from Germany (United Internet) and the USA (Berkshire Hathaway) respectively. And what happened with the share value of United Internet before 1998? Well, a lot! The company was first listed in 1998 at a price of €1,02 per share. At end 2016, the share price was €37. That’s an increase by a factor of more than 30 over less than 20 years. Sure, with plenty of ups and some downs during the last 20 years, but many more ups than downs.